1Win Lucky Jet: Strategies, Signals, and Hack APK

Lucky Jet is an extremely popular instant game that can be played exclusively at 1win casino. It is a unique game that combines luck and the actions of the player to determine the outcome that can reach up to x1,000 of your bet.

In this review, we will discuss all the details of the game, including its rules, how to play, and how to download the 1win Lucky Jet app. We will also provide tips and tricks to increase your chances of winning.

- What is the Lucky Jet Game?

- Animated Gameplay

- Instant Cashout

- Auto-Betting Options

- Live Bets and Statistics

- In-Game Chat

- Start Playing 1win Lucky Jet

- How to Play 1Win Lucky Jet?

- Lucky Jet 1Win App Download

- Lucky Jet Prediction: Understanding Provably Fair Technology

- How to Hack 1win Lucky Jet?

- 1Win Lucky Jet Signals

- Tips and Tricks to Help You Win

- Lucky Jet 1win Real or Fake?

- Benefits of Playing Lucky Jet at 1Win

- Quick and Easy Winnings

- Live Rounds for a Thrilling Experience

- Multiple Bets for Greater Flexibility

- Try Before Deposit with Free Demo Mode

- Competitive Atmosphere for an Engaging Experience

- Hints for Responsible Gambling

- Conclusion

- 1win Lucky Jet FAQ

What is the Lucky Jet Game?

Lucky Jet, the adrenaline-pumping arcade game, is taking the online gaming world by storm. Developed by Gaming Corps, this game has everything a gamer could want: excitement, strategy, and the opportunity to win big. And it’s available in OneWin casino!

If you are a beginner, then it can be difficult to understand the game’s rules and how to win. But with the right strategies and signals, you can improve your chances of winning.

Randomly generated for each game, Lucky Jet features a multiplier that grows the longer the plane rises. To play, simply place your bets and watch the animation as the plane takes off. The goal is to remove your bet as late as possible while avoiding the crash. The higher the multiplier grows, the greater your winnings will be when you withdraw your bet. But be warned: if you don’t remove your bet in time, you lose it all.

Lucky Jet has taken the best of Aviator game, improved it, and introduced it to players. Now it’s one of the most popular games of the last 5 years.

Here are some features that make Lucky Jet a favorite among gamers:

Animated Gameplay

Lucky Jet’s animation is nothing short of captivating. The sound effects and graphics are realistic, and the game’s fast-paced action keeps players on the edge of their seats. Whether you’re a beginner or an experienced gamer, Lucky Jet is easy to learn and fun to play at 1win.

Instant Cashout

At any time during the game, the player can decide to cashout in one click. By doing so, the player ejects from the plane before it crashes, thus multiplying their bet at the exact moment of withdrawal. The goal is to cash out as late as possible to maximize your winnings.

Auto-Betting Options

Lucky Jet also offers an auto bet feature, which allows you to automatically place bets on the panel of your choice. To activate this feature, simply tick the “Auto bet” line. However, you still need to press the “Withdrawal” button for each round if you want to withdraw your winnings.

For those who want to fully automate the game, there’s the auto withdrawal feature. By activating the “Auto Withdrawal” on the betting panel, your winnings will be automatically withdrawn when the coefficient you set is reached.

Live Bets and Statistics

On the left side of the screen (or underneath the betting panel if you’re using the mobile interface), you’ll find the “Live Bets” panel. This panel displays the bets made in the current round. Meanwhile, the “My Bets” panel provides information about your bets and withdrawals for the entire duration of the game.

Finally, the “Top” panel displays game statistics, including the winnings of other players in terms of both the amount and cashing coefficient. By checking this panel, you can keep track of the highest coefficients in the current round.

In-Game Chat

Last but not least, Lucky Jet features an in-game chat panel on the right side of the screen (or in the upper right corner on mobile). This panel allows you to communicate with other players, share tips and tricks, and celebrate big wins together.

Plus, information about receiving large winnings is automatically posted in the chat, so you can stay up-to-date with the latest news.

Start Playing 1win Lucky Jet

If you want to play at Lucky Jet, you’ll need to register at the casino. As an example, let’s consider registering at 1win casino. Follow these simple steps:

To get started, head over to the 1win website or app on your desktop or mobile device. The platform is user-friendly and easy to navigate, so you shouldn’t have any trouble finding what you need.

Once you’ve accessed the 1win platform, you’ll need to create an account to start playing Lucky Jet India for real money. This process is quick and straightforward – simply provide your name, email address, and a few other details to get started.

- Step 3: Deposit some funds into Your Balance

With your account set up, you’ll need to fund your balance with some Indian rupees (INR) to start playing. 1win offers a variety of payment methods, including popular options like bank transfer, UPI, and e-wallets, so you can choose the one that works best for you.

- Step 4: Find Lucky Jet on the 1win Homepage

Once you’ve deposited funds into your balance, it’s time to start playing Lucky Jet India. You can find the game on the 1win homepage, where it’s prominently featured alongside other popular casino games.

- Step 5: Start Playing and Win Big!

Now for the fun part – start playing Lucky Jet India and see if Lady Luck is on your side. As you play, your winnings will accumulate and be displayed in your balance. And when you’re ready to cash out, simply request a withdrawal from 1win and your winnings will be transferred to your account.

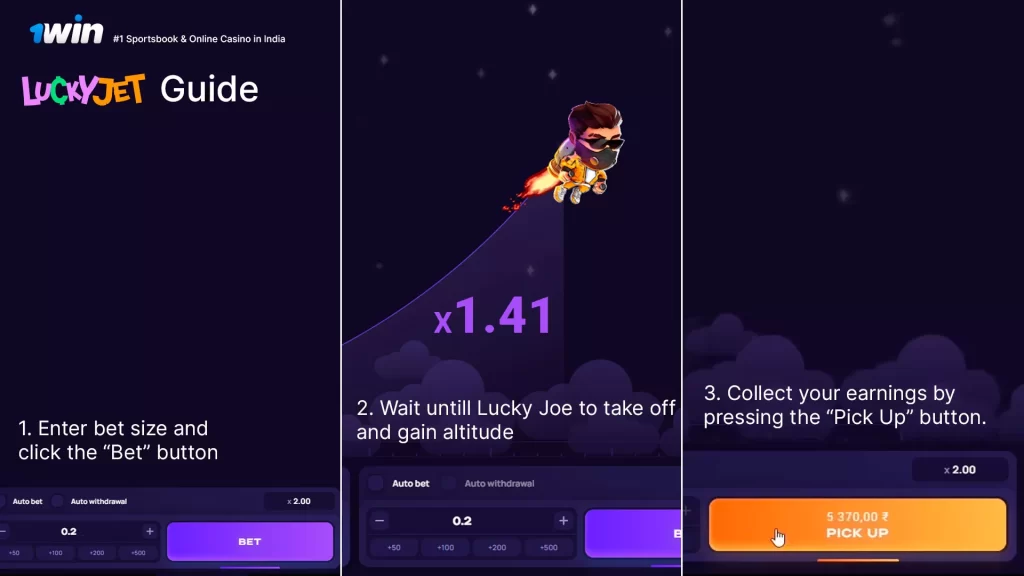

How to Play 1Win Lucky Jet?

Are you ready to try your luck and win big with the Lucky Jet game? In this guide, we will explain how to play and what the rules are for this exciting game. With our tips and tricks, you can maximize your chances of winning and have a great time in the process.

- Placing Bets in Lucky Jet

To place a bet in Lucky Jet, simply select the desired amount and click the “Bet” button. And the best part is, you can place multiple bets at the same time using both the left and right betting panels. This means that you can increase your chances of winning by betting on multiple outcomes.

- Withdrawing Winnings

If you’re lucky enough to win, you can withdraw your winnings by clicking the “Withdrawal” button. Your winnings are calculated by multiplying your bet by the cashout multiplier.

It’s important to note that if you don’t withdraw your winnings before Lucky Joe flies away, your bet will be lost.

Lucky Jet 1Win App Download

Unfortunately, there isn’t a dedicated app for Lucky Jet as it’s just one of the many casino games available. However, you can easily access Lucky Jet by downloading the 1win app, which houses a vast collection of casino games, including Lucky Jet.

To download 1win Lucky Jet app, follow these steps:

- Go to the 1win website. Type it’s url in your browser or just click any link on our website.

- Scroll down to the bottom of the homepage and look for the download button with the logo of your phone’s OS.

- If you’re using an Android device, you may need to change a setting to allow installation from unknown sources. To do this, go to your device’s Settings > Security > Unknown sources, and toggle the switch to enable it. Keep in mind that installing apps from unknown sources can pose a security risk, so make sure you trust the app you’re downloading.

- Click on the download button to begin downloading the 1win Lucky Jet app.

- Once the download is complete, open the APK file to begin installation.

- Follow the prompts to complete the installation process. You may be asked to grant permissions or provide additional information during the installation.

- Once the installation is complete, you can open the 1win Lucky Jet app and start using it.

Once you’ve downloaded and installed the Lucky Jet app, you’ll have full access to all casino features.

Keep in mind that it’s important to only download 1win Lucky jet app only from 1win genuine website. Installing apps from unverified sources can put your device and personal information at risk. Additionally, be sure to regularly update your apps to ensure you have the latest security features and bug fixes.

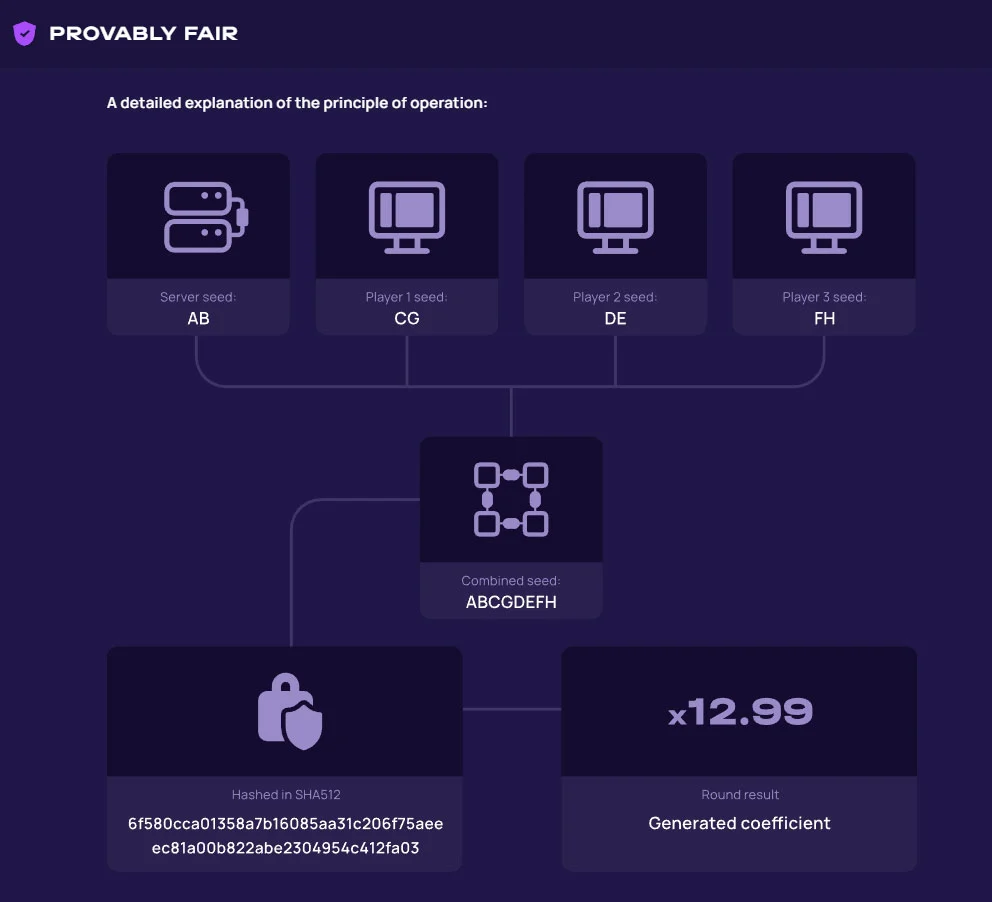

Lucky Jet Prediction: Understanding Provably Fair Technology

The Lucky Jet game is powered by Provably Fair technology, a state-of-the-art system that uses artificial intelligence and a random number generator to determine the outcome of each round.

This makes it impossible to predict the winning outcome in advance. Moreover, the game is equipped with safeguards against unauthorized access and third-party interference, which guarantees a fair and secure gaming experience for all players.

The following factors are controlled at the software level:

- Odds, which are generated based on code on the provider’s server as well as the nodes of the three random players.

- Duration of the flight, which can be analyzed and predicted based on the previous parameter.

- Volatility, which describes the level of risk and shows how often and in what amount you can get winnings when placing bets.

While it’s impossible to make absolutely correct predictions, there are some Lucky Jet signals that you can use to reduce the risk of losing and systematize your winnings while betting.

How to Hack 1win Lucky Jet?

However, with the rise of YouTube and Telegram channels that claim to provide Lucky Jet signals and hacked apps, many players are wondering if they can cheat the game and increase their chances of winning.

- Cheating is impossible in 1Win Lucky Jet. The game uses Provably FAIR technology to generate a unique and random result that cannot be tampered with.

- Downloading hacked apps can compromise your data and account access, so only download the 1win app from the official website.

- YouTube and Telegram channels claiming to provide guaranteed win signals are fraudulent. There is no such thing as a 1win Lucky Jet predictor.

- Using cheat codes can result in your account being banned.

Play honestly, as the game offers excellent chances of winning. If you have additional questions about the legality of particular actions, you can check out our guide “Is 1win legal in India?“

1Win Lucky Jet Signals

At 1Win, Lucky Jet enthusiasts have come up with their own signal systems in hopes of increasing their chances of winning. Some examples of these signals include noticing a repeating pattern in playing sessions where a high multiplier appears after four consecutive low odds. It’s worth noting that roughly 80% to 90% of all Lucky Jet rounds have odds from 1.18 and above, meaning that reacting in time and cashing out at a given quote could potentially lead to a win.

While some Telegram channels offer special bots that can supposedly calculate the outcome of the next round using statistical data and quotes, there’s no guarantee that these bots will work. Ultimately, each player determines their own winning strategy, but the reality is that there’s no single recipe that can guarantee victory. As Lucky Jet is based on a random number generator, the outcome of each round is entirely random and making an accurate Lucky Jet prediction is impossible.

However, players can still employ strategies such as the upside strategy – increasing their bets if they lose a round – or analyzing the history of previous rounds to try to predict the outcome of the next round. But it’s important to keep in mind that even with these strategies, there’s no guarantee of victory.

Tips and Tricks to Help You Win

While there’s no guaranteed way to win, there are some tips and tricks that can help you increase your chances of winning. In this part, we’ll discuss some strategies that you can use to improve your Lucky Jet game:

- Cash out at small odds. If you’re new to Lucky Jet, it’s best to cash out at small odds and play the demo version of the game before you start betting with real money. Small odds (i.e., 1.2-1.7) may not provide a large payout, but they offer a higher chance of winning. As you become more familiar with the game mechanics and gain confidence, you can gradually increase your odds and bet size.

- Pay attention to Lucky Jet signals but play honestly. Lucky Jet signals are hints that are calculated based on statistics from previous draws of rounds. While they don’t guarantee a win, they can help you reduce the risk of losing and systematize your winnings while betting. Pay attention to these signals and adjust your betting strategy accordingly. However, it’s essential to play honestly and not rely solely on Lucky Jet signals to win.

- Relax and have fun. One of the most crucial Lucky Jet strategies is to relax and have fun. Remember that the outcome of each round is random, and it’s impossible to make a true Lucky Jet prediction. Don’t be too greedy in the pursuit of high odds! Instead, enjoy the game and set realistic expectations. This way, you’ll be able to play more responsibly and avoid chasing losses.

Lucky Jet 1win Real or Fake?

The Lucky Jet game is real and you can play it at the casino 1win.

Benefits of Playing Lucky Jet at 1Win

Let’s take a closer look at the benefits of playing Lucky Jet at 1Win.

Quick and Easy Winnings

One of the biggest benefits of playing Lucky Jet at 1Win is the speed with which you can win money. Rupiahs are credited to your account almost immediately when you click the cashout button, allowing you to enjoy your winnings as soon as possible. Whether you’re looking to win big or just enjoy a quick payout, Lucky Jet offers a fast and reliable way to do so.

Live Rounds for a Thrilling Experience

Another great feature of Lucky Jet is that all rounds are live. This means that the results are the same for all users, ensuring a fair and exciting experience for everyone involved. Whether you’re playing for fun or aiming for a big win, the live rounds of Lucky Jet provide a thrilling and dynamic atmosphere that you’re sure to enjoy.

Multiple Bets for Greater Flexibility

If you’re looking for even more flexibility in your gameplay, Lucky Jet has you covered. You can place up to two bets per round, allowing you to cash out one early and keep the other going for a chance at a bigger win. This gives you greater control over your strategy and allows you to tailor your gameplay to your individual preferences.

Try Before Deposit with Free Demo Mode

If you’re new to Lucky Jet or just want to get a feel for the game before you start playing for real money, you can take advantage of the free demo mode. This allows you to play the game without risking any money, giving you a chance to learn the basics and get comfortable with the gameplay before you start placing bets.

Competitive Atmosphere for an Engaging Experience

Finally, Lucky Jet at 1Win offers a competitive atmosphere that makes every round exciting. You can see other users’ bets and compete against them, which adds an extra level of engagement and excitement to the game. Whether you’re a seasoned player or new to the world of online gaming, Lucky Jet provides an engaging and entertaining experience that you’re sure to love.

Hints for Responsible Gambling

While there may not be a guaranteed way to win at 1Win Lucky Jet, there are some tips and strategies that can increase your chances of winning:

- Start with small bets and gradually increase them as you become more comfortable with the game.

- Keep track of your previous bets and outcomes to identify patterns and adjust your strategy accordingly.

- Consider using the auto-play feature to quickly place multiple bets.

- Take advantage of any bonuses or 1win voucher code to maximize your winnings.

- Don’t chase losses and know when to stop playing.

By following these tips and strategies, you can potentially increase your chances of winning at 1Win Lucky Jet.

Conclusion

1Win Lucky Jet is a fun and exciting game that offers the chance to win big prizes. However, it is important to approach the game with a responsible mindset and use strategies to increase your chances of winning. Remember to always play within your means and to never use illegal hack APKs or other cheating methods. With a bit of luck and the right strategy, you may just hit the jackpot at 1Win Lucky Jet.

ПОБЕГ ОТ ЛИЗОГУБА Kaulquappe228 · Приключения

Конфиденциальные данные могут использоваться по-разному в зависимости от вашего возраста, задействованных функций или других факторов. Подробнее

Совместимость iPhone Требуется iOS 15.2 или новее. iPad Требуется iPadOS 15.2 или новее. iPod touch Требуется iOS 15.2 или новее. Mac Требуется macOS 12.1 или новее и компьютер Mac с чипом Apple M1 или новее.

Теперь вам не придется ехать в Лас-Вегас, ведь Lucky Jet — это казино прямо в вашем кармане! Безопасные и бесплатные игровые автоматы 1 win, рулетка и слоты Lucky Jet позволят вам насладиться азартом без риска для вашего кошелька! Наше онлайн-казино предлагает захватывающий и безопасный игровой процесс. Вы сможете наслаждаться игрой и выигрышами с Lucky Jet 777. А если у вас возникнут вопросы, наша служба поддержки клиентов всегда готова помочь. Ощутите азарт и острые ощущения казино без необходимости рисковать — просто наслаждайтесь игрой сколько угодно и когда угодно. Более того, вам не придется ждать, пока игры загрузятся — наша технология обеспечивает быструю загрузку и плавный геймплей!

Новая школа открылась в День знаний в деревне Епанчина Тобольского района. В современном модульном одноэтажном здании, рассчитанном на 20 учеников, оборудованы кабинеты для школьников и дошкольников, гимнастический зал, буфет и игровая зона.

It is alleged that the suspects immediately made a demand for the woman’s keys. Police say that the woman attempted to run to the casino but was pushed to the ground.

Не только дедушка Зевс, но и многие другие, в которые можно попробовать сыграть и получить призы. Некоторые из них:

TikTok TikTok Pte. Ltd. · Социальные

:

- Игровые Аппараты Онлайн На Деньги 1win

- 1win Casino 1 Win

- Играть В Слоты С Акулой 1 Win

- 1 Вин Зеркало Слоты Скачать

- Слоты Фриспины В 1 Вин

- Игра Авиатор 1вин Промокод

- Дешевые Слоты На 1win