Lucky Jet игра на деньги: стратегии, взлом и вся правда о проекте

Lucky Jet – игра на деньги визуализирующая увеличение коэффициента по ставке пользователя, что создает иллюзию контроля за происходящим. Фактически это банальный игровой автомат онлайн казино в непривычном оформлении, привлекающем внимание гемблеров кажущейся новизной. Но даже в этом игра Лаки Джет краш не привносит в индустрию ничего новаторского, являясь точной копией таких нашумевших азартных проектов, как разоблаченная нами игра на деньги Авиатор и другие развлечения в жанре краш. Единственное отличие – вместо самолета мы наблюдаем на экране Счастливчика Джо с реактивным рюкзаком удачи за спиной.

Игра на деньги с выводом Lucky Jet в 1WIN стала очередным хитом развлекательного лобби данного онлайн казино, ведь в точности повторила механику азартного слота Aviator, уже имеющего немалую фанатскую базу. Мы же предлагаем изучить, как устроена новая краш игра на деньги Лаки Джет, реально ли в ней заработать и отзывы тех, кто уже пытался обогатиться за счет Счастливчика Джо.

Как играть в Lucky Jet game на деньги: правила и геймплей

Правила автомата просты: от пользователя требуется сделать ставку и успеть обналичить ее до того момента, как Джо улетит за пределы игрового экрана и увеличение коэффициента резко оборвется. Если не сделать этого вовремя, сумма пари безвозвратно сгорает, заработок в Lucky Jet game равняется нулю.

В данном случае множитель зависит от того, как долго парень с ранцем продержится в воздухе и момента расчета ставки игроком.

Перед тем как запустить игру на деньги Lucky Jet в 1WIN, стоит учесть ряд моментов:

- Каждый полет Счастливчика Джо представляет собой один игровой раунд.

- Время полета является эквивалентом итогового коэффициента, на который умножается сумма ставки. Максимальный множитель достигает Х100, в отдельных казино этот показатель может быть увеличен до Х200.

- Потенциальная доходность автомата, как уверяют разработчики, зависит от скорости реакции и азартности игрока, но это ложь! В действительности софт контролируется программным алгоритмом, который физически не даст владельцу слота на дистанции уйти в минус. Это значит, что онлайн казино всегда имеет математическое преимущество перед игроком, который рано или поздно сольет весь депозит.

Лаки Джет от 1WIN – азартная игра на деньги, в ней нет возможности рассчитать вероятность выигрыша, увеличить шансы на успех или выявить закономерности, позволяющие ставить с выгодой. Тем не менее создаются все новые стратегии, как выиграть в Lucky Jet. Об их реальной эффективности мы поговорим далее.

Игра Lucky Jet: стратегия как играть и можно ли выиграть

Отвечая на поставленный вопрос, разумеется, выиграть можно, но ни о какой систематичности в получении дохода речи не идет. Это будут разовые плюсовые ставки, которые при игре в долгую не покроют и части убытка. Собственно, так устроен любой цифровой слот, коим и является игра Лаки Джет от 1WIN. Несомненно, операторам азартных развлечений выгодно, чтобы вы думали иначе. Поэтому ими создаются легенды о беспроигрышных стратегиях, которые затем распространяются партнерами казино, зарабатывающими за счет привлечения рефералов.

Сегодня существует три популярных, но на деле бестолковых тактики для Лаки Джет краш:

- Мартингейл или догон. Стратегия Lucky Jet game – игра ведется с удвоением суммы пари в случае проигрыша и расчета ставки в момент, когда коэффициент достигает значения 2.00. Убыточность метода Мартингейла в долгосрочной перспективе неоднократно доказана, поэтому заострять внимания на этом мы не станем.

- 4 синих икса. Многие пользователи убеждены, что после того, как по линии коэффициентов идет серия из 4 синих множителей, следом за ней можно ловить высокий коэффициент. Статистически это наблюдение никак не обосновано, все попытки доказать работоспособность данной системы не увенчались успехом.

- Игра Lucky Jet 1Win на низких коэффициентах. Бытует мнение, что Счастливчик Джо в 90% случаев долетает до множителя 1.20, следовательно, для стабильного выигрыша якобы достаточно делать расчет ставки немногим ранее. Это очередной миф, так как выпадение коэффициентов в слоте абсолютно случайно.

Из вышеизложенного материала следует, что как выиграть в Lucky Jet – не подскажет ни одна стратегия, все это обман!

Начните зарабатывать прямо сейчас

Выбирайте проверенных каперов

Lucky Jet: как взломать?

Ответ – никак! Софт Лаки Джет краш находится в распоряжении разработчика и физически размещен на собственных серверах, даже взломав которые не выйдет повлиять на исход раундов. Дело в том, что алгоритмы слота контролируются генератором случайных чисел на основе PROVABLY FAIR, формирующего коэффициент выигрыша без участия оператора. Как не «шамань» с кодом, взломать Lucky Jet не удастся!

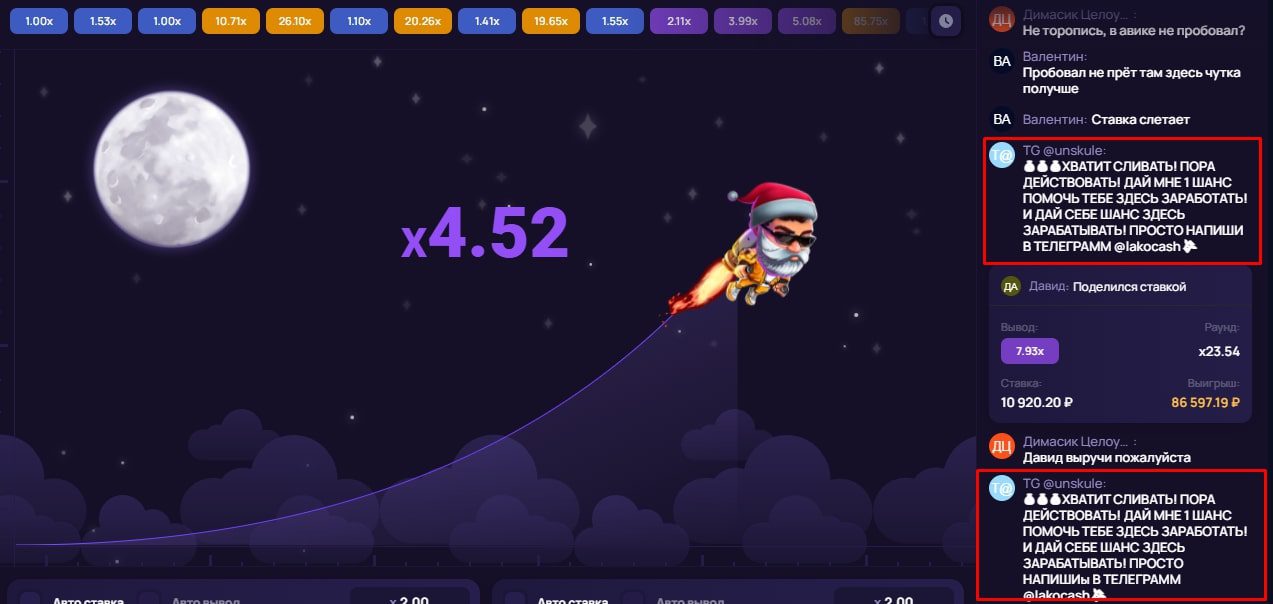

Каждый из дельцов, заявляющих, что знает, как взломать Lucky Jet – мошенник, продающий неработающие скрипты и фейковые схемы.

ТОП-3 Лучших капперов:

| 🥇 1 место | 🥈 2 место | 🥉 3 место |

Lucky Jet игра на деньги: отзывы игроков

Если проанализировать реальные отзывы игроков в Lucky Jet, заработать здесь деньги не выйдет. Депозит медленно, но уверенно уходит в минус, а если еще и выбрана рискованная стратегия, вроде Мартингейла, вовсе можно слиться за одну игровую сессию.

Заключение

Невзирая на то, что Lucky Jet – игра на деньги с выводом, обналичивать счет здесь приходится не так часто, ведь в большинстве своем пользователи терпят финансовые неудачи в попытках поймать крупный куш. Проект относится к азартным развлечениям с отрицательным математическим ожиданием, поэтому не стоит рассматривать его как стабильный источник дохода, иначе потеряете все!

Если ищете не только возможность выплеснуть адреналин, но и заработать на этом, мы бы советовали посмотреть лучше в сторону ставок на спорт. Здесь ваш потенциал не ограничен алгоритмами софта, а доходность зависит от навыков анализа и знаний спортивных дисциплин. Если слабо разбираетесь в беттинге, предлагаем изучить наш рейтинг проверенных капперов, которым можно доверять на основе клиентских отзывов и наших личных проверок. Заключая пари по надежным рекомендациям опытного специалиста вы быстро приумножите банк и ощутите финансовый подъем.

#3518 по оценкам пользователей

Проект Baxov.Net нашел всю информацию о домене aviator-1win.ru. Узнайте всю правду о проекте от пользователей. Только честные и правдивые отзывы. Не дай себя обмануть.

Content Предлагает ли в 1win бездепозитный бонус? Служба поддержки клиентов 1win Приветственный бонус 1win за регистрацию Мобильная версия сайта 1win Как играть в 1Win Казино — пособие in Букмекер официальный сайт: рабочее зеркало казино Как скачать 1win зеркало официального сайта онлайн казино 1win вход зеркало Казино, Зеркало, Слот официальный сайт букмекерской конторы 🎁 Бонусная политика […]

Информация о ресурсе представлена исключительно в информационных целях и получена с официальных реестров РКН.

2й и 4й барабаны заполнены загадочными символами, которые смещаются на 1 с каждым вращением и применяют множитель к каждому выигрышу. При входе в функцию с дополнительными скаттерами складываются загадочные символы, и присуждаются дополнительные бесплатные вращения.

Символика этого автомата довольно простая:

Lucky Jet — это онлайн-платформа для азартных игр, которая предоставляет вам возможность стать настоящим тайкуном казино. Здесь вы можете найти более 3 000 игровых автоматов, 9 000 слотов и множество других игр, на которые вы можете делать ставки. Все эти игры доступны в демо-режиме, который позволит вам проверить свою удачу и играть в игру, не теряя своей виртуальной валюты. Lucky Jet — это платформа для азартных игр в режиме реального времени, где вы можете зарабатывать деньги, делая ставки на различные события, такие как футбол, баскетбол, бейсбол, хоккей, теннис, гольф и многие другие.

Каждому пользователю предлагается большое количество вариантов для ставок на всевозможные дисциплины. Основными среди них являются:

Также вместе с aviator 1win вход ищут:

- 1вин Автоматы 1 Win17 Xyz

- 1 Win Игровые Автоматы Зеркало

- Игровые Автоматы 1 Вин

- Aviator 1win Вход

- 1win Автоматы 1win Sdf Official Azurewebsites

- Скачать 1 Вин Игровые Автоматы Андроид