1win — plataforma de apostas e cassino

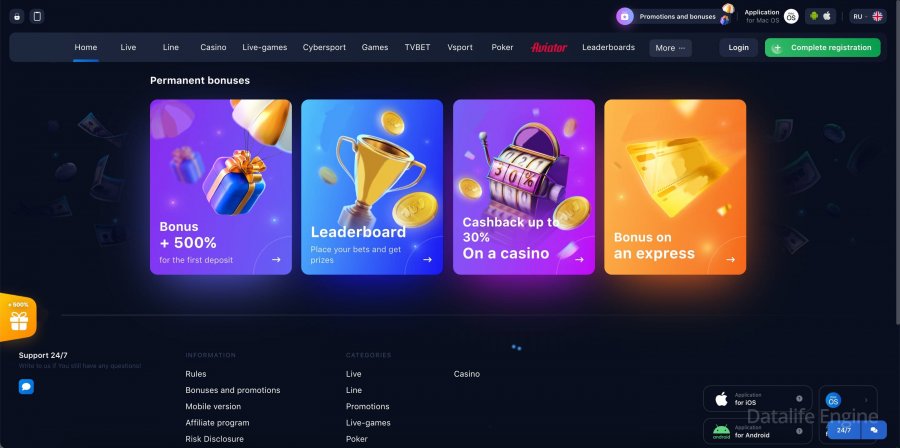

Programa de bônus e fidelidade da empresa de apostas 1win

16-11-2019, 19:31

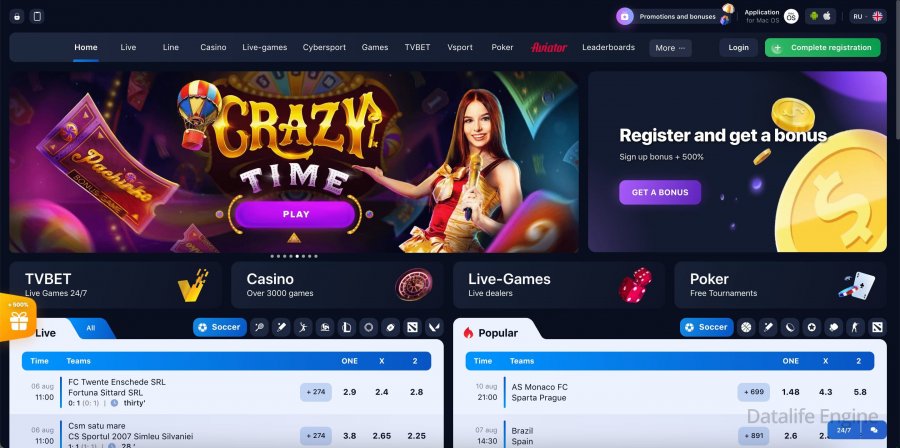

As casas de apostas estão constantemente a melhorar o seu programa de fidelização para atrair novos clientes e manter o interesse dos jogadores habituais. No entanto, todas as organizações costumam aumentar o número de ofertas promocionais e não pensam em aumentar a quantidade de ganhos. A organização 1win decidiu seguir um caminho diferente. Por exemplo, uma casa de apostas pode oferecer a seus clientes um bônus de boas-vindas para adicionar até 500% à sua conta. Cujo recibo é distribuído pelos quatro primeiros depósitos.

Este artigo discutirá em detalhes o programa de bônus 1win, bem como as condições para apostar e receber bônus. Para receber qualquer um dos bônus existentes, primeiro você precisa se registrar. Sem passar pelo qual não será possível participar de ofertas promocionais. Ao preencher o questionário, você pode inserir um código promocional especial que oferece a oportunidade de aumentar o bônus de boas-vindas. Graças a este código, os usuários podem receber o dobro da quantia de fundos já no primeiro reabastecimento da conta de jogo.

Isto é importante!

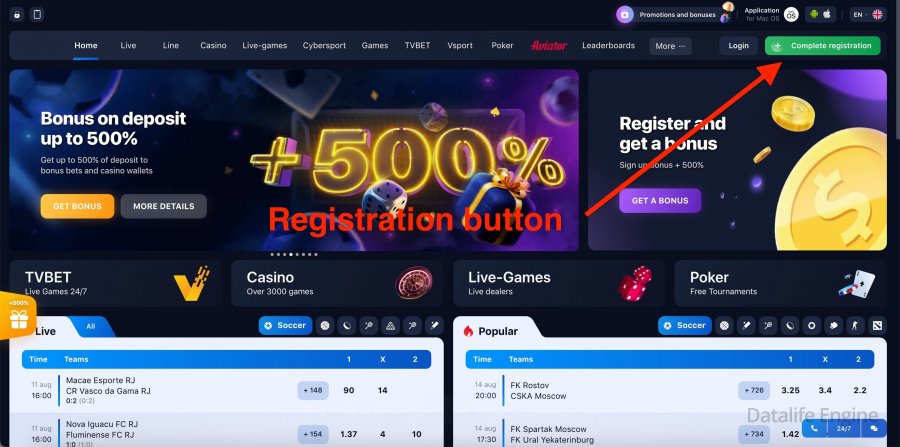

Como se registrar no 1win

16-11-2019, 17:47

A casa de apostas 1win é uma casa de apostas relativamente jovem, que iniciou as suas atividades em 2016. Até 2018, a organização tinha um nome diferente, nomeadamente FirstBet. A casa de apostas é considerada popular nos países da CEI, o que pode ser explicado por várias razões. No entanto, a organização atrai especialmente novos usuários com um generoso bônus de primeiro depósito. Basicamente, a casa de apostas suporta apostadores que falam russo, mas a plataforma também é adaptada para outros 9 idiomas.

A organização opera no território da Rússia sem uma licença apropriada, uma vez que está legalmente registrada em Curaçao. A principal vantagem da casa de apostas é o fornecimento de bônus generosos para novos jogadores em comparação com organizações semelhantes. No site oficial, os clientes poderão concluir não apenas negócios esportivos, mas também encontrar um esporte virtual, cassino online, loteria, caixas e pôquer. Como parceiros, BK escolheu projetos de grandes marcas, incluindo blogueiros populares.

Processo de inscrição no site 1win

O processo de registro na plataforma 1win geralmente ocorre sem problemas. Para registrar um novo jogador, você precisa inserir dados pessoais que confirmem sua identidade usando e-mail ou número de telefone. Depois disso, o apostador pode usar sua conta e fechar negócios para qualquer evento esportivo. No entanto, nem todas as casas de apostas têm condições tão simples de registo. Assim, por exemplo, algumas organizações podem ser caracterizadas por suas próprias peculiaridades e nuances, se desconhecer quais o jogador pode enfrentar alguns problemas no futuro.

Isto é importante!

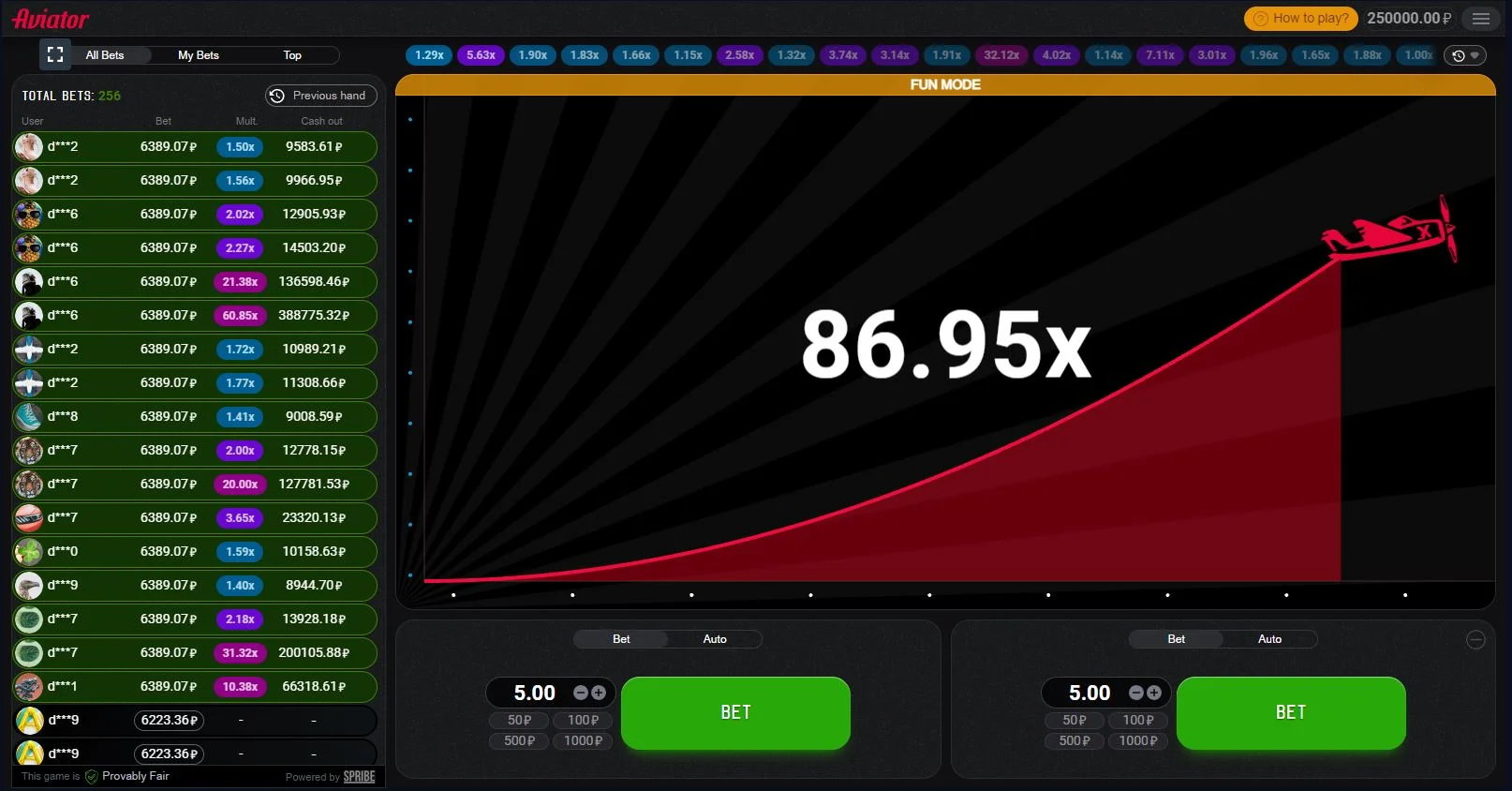

Como jogar o jogo Aviator em 1win

15-08-2022, 15:10

O jogo Aviator é um produto social multiplayer que os jogadores gostam de chamar de Planescape. Este jogo ajuda a se divertir e a se divertir, recarregar o espírito e relaxar depois de um dia de trabalho duro. O ponto do 1win aviator é que o usuário está vendo a curva aumentar. Ao mesmo tempo, ele tem que pressionar o «stop» botão no tempo, pois o tabuleiro pode cair a qualquer momento. Este é o mesmo entretenimento que carrega a adrenalina. Além disso, você pode apostar no avião de graça, devido aos bônus.

Ao jogar 1win aviator no site oficial, o usuário pode aumentar em várias vezes as chances de ganhar. O principal é seguir as regras e levar em conta as recomendações. Neste artigo, falaremos mais sobre o 1win aviator.

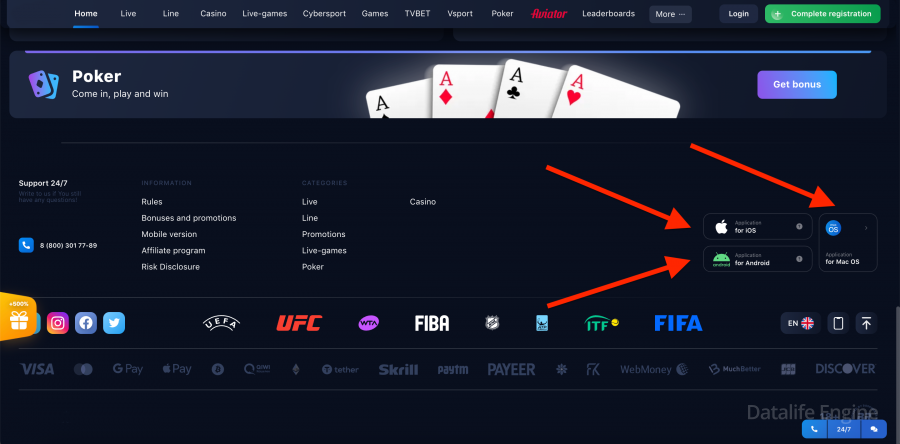

Download 1win app para andróide

26-05-2021, 15:37

Você pode fazer apostas em eventos esportivos, girar slots em cassinos e monitorar os resultados dos jogos não apenas sentado em um computador desktop ou laptop. É muito mais conveniente fazer isso do seu telefone ou tablet. Tudo que você precisa é baixar 1win para android.

Especificações:

| O desenvolvedor | 1win |

| O tamanho | 14 MB |

| Versão do SO necessária | 4.1+ |

| Formato | apk |

| Língua | inglês |

O aplicativo móvel 1win no seu dispositivo permitirá que você aposte a qualquer hora, em qualquer lugar. O processo de download do arquivo apk não leva muito tempo, e a instalação é simples e disponível para todos os usuários.

Como baixar e instalar 1win apk para android

Todo apostador que usa um gadget no sistema operacional Android pode baixar o aplicativo 1win em seu dispositivo. O arquivo Apk está disponível em nosso site oficial. Clique no botão correspondente no cabeçalho do site, após o qual o aplicativo começará a ser baixado no seu dispositivo. Para instalar o arquivo baixado, você deve executar as seguintes etapas:

1WIN link alternativo

8-04-2021, 18:16

Um espelho de trabalho é uma alternativa ao site oficial, uma cópia completa dele com todas as funcionalidades preservadas. Ele pode estar localizado em um domínio diferente, ou seja, pode ter um nome diferente para a barra de endereços. O trabalho com espelhos é realizado para garantir segurança, otimização, ao alterar a URL. Ao criar um portal da web, os desenvolvedores criam duas ou mais versões dele de uma só vez. Os mecanismos de pesquisa consideram os servidores espelhados se a barra de pesquisa exibir uma assinatura com e sem a WWW. Um espelho também é chamado de domínio atribuído ao recurso principal. Se um usuário for para uma duplicata, o sistema o redireciona automaticamente para o portal principal.

Para que serve um link alternativo?

Proprietários de casas de apostas, incluindo 1win, cassinos online e algumas lojas online hoje, observam que elas são frequentemente bloqueadas. O bloqueio pode ser realizado por agências governamentais ou motores de busca. Eles filtram spam, informações falsas, serviços fraudulentos. Além disso, mesmo aqueles que trabalham honestamente estão sujeitos ao fechamento. É absolutamente impossível prever tais manipulações.

O espelho de trabalho 1win melhora a estabilidade do portal web. Se por algum motivo o servidor principal ficar indisponível, os visitantes serão redirecionados automaticamente para um servidor alternativo. Muitos criadores usam cópias como armazenamento de backup.

Além disso, o recurso copiado ajuda a manter a credibilidade da empresa em caso de transição para um novo domínio. Nesse caso, o cliente, seguindo a URL antiga, é transferido para a nova.

1win cassino

28-02-2021, 11:05

- Informações sobre o cassino

- 46 762

- 0

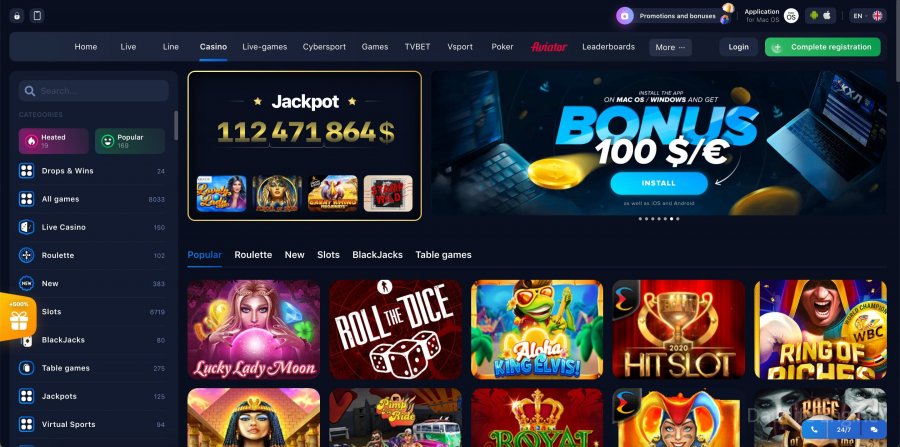

1WIN hoje não é apenas um recurso popular para apostas esportivas online, mas um cassino online bem conhecido. Aqui todos podem experimentar uma variedade de máquinas caça-níqueis dos principais fabricantes. Oferece aos clientes uma extensa lista de jogos de tabuleiro, bem como a oportunidade de competir com revendedores reais. O site oficial do cassino 1win é uma recomendação digna e excelente, apoiada por uma reputação sólida de longa data. As atividades do cassino são regulamentadas com base em um contrato de licença.

site oficial do cassino 1win

O 1win Casino opera sob uma licença do Fr. Curaçao de acordo com a legislação da cidadania indicada. Os fornecedores de software para 1 WIN são gigantes da indústria como Yggdrasil, Edorphina, Amatic, Play’n GO, GamART, EGT, Playson e outros desenvolvedores TOP semelhantes. Os jogadores do casino de 1 vinhos são oferecidos uma grande variedade dentro de 1000 jogos. Isso inclui apostas esportivas padrão, jogos de TV, jogos ao vivo, opções de jogos no aplicativo móvel, bem como o torneio de pôquer mensal mais popular!

O site da casa de apostas 1win é construído pelos desenvolvedores da forma mais clara possível, a interface é simples graças à navegação conveniente com ícones. O site distingue-se pela usabilidade de alta qualidade, sendo um elemento chave da estratégia da 1win. O suporte técnico funciona 24 horas por dia, 7 dias por semana, garantindo respostas 24 horas por dia às perguntas dos clientes (por e-mail, chat com um operador, por telefone). Os diálogos são realizados em vários idiomas ao redor do mundo.

Content in Казино официальный сайт: зеркало, регистрация на сайте букмекерской конторы 1 вин Классические игровые слоты Регистрация в букмекерской конторе через социальные сети Другие букмекеры Comentários Зарегистрируйтесь в приложении Букмекера 1Вин Вся правда об игре Авиатор Для чего создают зеркала на сайт 1win? Версии Недостатки приложения Можно найти актуальное зеркало сегодня мостбет зеркало в ВК? […]

Совместимость iPhone Требуется iOS 7.0 или новее. iPad Требуется iPadOS 7.0 или новее. iPod touch Требуется iOS 7.0 или новее. Mac Требуется macOS 11.0 или новее и компьютер Mac с чипом Apple M1 или новее.

Все большую популярность набирают так называемые краш-игры. Одной из таких является Jet X. Ее суть в том, что пока летит самолет, увеличивается коэффициент выигрыша. Если пользователь успеет вывести

Psiphon Pro Psiphon Inc. · Связь

PT. Mentari Niaga Utama merupakan perusahaan yang bergerak di bidang perdagangan besar yang melayani penjualan daging dan produsen pupuk hayati Bioneensis.

Откуда еще найти это 1 Win Автоматы Зеркало ищут:

- 1 Win Игровые Автоматы 1win Xcv

- Скачать 1win Игровые Автоматы Андроид

- 1вин Игровые Автоматы На Деньги Скачать Бесплатно

- 1win Приложение 1win Stavki Casino Xyz

- 1 Win Слоты Играть